We don’t have to tell you that insurance companies don’t want you to look for a cheaper policy. Drivers who get price comparisons will, in all likelihood, switch to a new company because of the good chance of finding a cheaper policy. A recent survey discovered that consumers who regularly shopped around saved $3,450 over four years compared to those who never shopped around for lower prices.

We don’t have to tell you that insurance companies don’t want you to look for a cheaper policy. Drivers who get price comparisons will, in all likelihood, switch to a new company because of the good chance of finding a cheaper policy. A recent survey discovered that consumers who regularly shopped around saved $3,450 over four years compared to those who never shopped around for lower prices.

If finding the best rates on insurance in Baltimore is the reason for your visit, then having a grasp of how to get price quotes and compare cheaper coverage can help simplify the task of finding more affordable coverage.

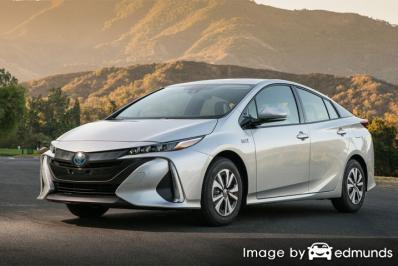

Truthfully, the best way to get more affordable Toyota Prius Prime insurance in Baltimore is to regularly compare quotes from insurers who provide car insurance in Maryland.

- Step 1: Read and learn about what is in your policy and the changes you can make to prevent high rates. Many things that cause rate increases like at-fault accidents, careless driving, and a low credit rating can be improved by making small lifestyle or driving habit changes. Later in this article we will cover additional ideas to get affordable coverage and get additional discounts that may be available.

- Step 2: Obtain price quotes from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can only quote rates from a single company like Progressive or Farmers Insurance, while independent agents can quote prices for many different companies.

- Step 3: Compare the price quotes to your existing rates to see if a cheaper price is available in Baltimore. If you can save some money and switch companies, ensure coverage does not lapse between policies.

The key thing to remember is that you use identical limits and deductibles on each price quote and to quote with as many different companies as possible. This ensures a fair rate comparison and the best price selection.

Keep in mind that comparing a wide range of rates will increase your chances of finding a lower rate.

The companies shown below provide quotes in Maryland. If you want cheap auto insurance in MD, it’s a good idea that you get prices from several of them to get the most affordable price.

Protect more than your Prius Prime

Despite the high insurance cost for a Toyota Prius Prime in Baltimore, buying car insurance may be required and benefits you in several ways.

First, almost all states have mandatory liability insurance requirements which means the state requires a specific minimum amount of liability protection if you drive a vehicle. In Maryland these limits are 30/60/15 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

Second, if your car has a loan, it’s guaranteed your bank will force you to have insurance to protect their interest in the vehicle. If coverage lapses or is canceled, the bank may insure your Toyota at a significantly higher premium and force you to pay the higher price.

Third, insurance protects both your assets and your Toyota Prius Prime. It also can pay for hospital and medical expenses for yourself as well as anyone injured by you. Liability insurance will also pay for a defense attorney in the event you are sued. If your car is damaged in a storm or accident, comprehensive (other-than-collision) and collision coverage will pay all costs to repair after the deductible has been paid.

The benefits of buying car insurance definitely exceed the cost, especially if you ever need it. The average driver in America overpays as much as $830 a year so we recommend shopping around at every renewal to ensure rates are competitive.

Reduce Insurance Rates with These Tips

Many things are part of the equation when quoting car insurance. Some are obvious like an MVR report, but other criteria are more transparent such as whether you are married or your vehicle rating. A large part of saving on car insurance is knowing some of the elements that play a part in calculating your premiums. If you understand what influences your rates, this enables informed choices that could result in better car insurance rates.

- Increase coverage deductibles and save – Comp and collision deductibles define how much you are willing to pay out-of-pocket before a claim is paid by your company. Physical damage insurance, also known as collision and other-than-collision, insures against damage to your car. Some instances where coverage would apply are colliding with a stationary object, animal collisions, or theft of your vehicle. The more the insured has to pay upfront, the less your company will charge you for insurance.

- Where you reside can affect rates – Choosing to live in a rural area has definite advantages when trying to find low car insurance rates. People who live in big cities have more traffic problems and longer commute times. Fewer drivers on the road means reduced accidents and also fewer theft and vandalism claims.

- Is you vocation costing you more? – Jobs like military personnel, executives, and accountants are shown to have higher rates than the rest of us due to intense work situations and lots of time spent away from family. On the flip side, jobs such as actors, engineers and homemakers receive lower rates.

- GPS tracking and theft deterrents reduce premiums – Buying a car with a theft deterrent system can save you some money. Anti-theft features such as OnStar, LoJack tracking, and tamper alarms all help stop auto theft.

- Getting married reduces risk – Having a spouse may earn you lower rates on your car insurance bill. Having a spouse may mean you are more financially stable and it’s statistically proven that being married results in fewer claims.

- Defend yourself with liability insurance – Liability coverage will protect you if ever a court rules you are at fault for an accident. Your policy’s liability insurance provides for a legal defense which can be incredibly expensive. Liability insurance is quite affordable compared to comp and collision, so drivers should buy more than the minimum limits required by law.

Tailor your auto insurance coverage to you

When it comes to buying coverage online or from an agent for your personal vehicles, there is no one size fits all plan. Everyone’s situation is unique.

These are some specific questions may help highlight if your insurance needs could use an agent’s help.

- Do I need an umbrella policy?

- When should I remove comp and collision on my Toyota Prius Prime?

- Can good grades get a discount?

- When should I not file a claim?

- Can I afford to pay high deductible claims out of pocket?

- Am I covered if I crash into my own garage door?

- Is upholstery damage covered by car insurance?

- Are my custom wheels covered?

If you’re not sure about those questions but one or more may apply to you, you might consider talking to an agent. If you don’t have a local agent, simply complete this short form.

Best car insurance in Baltimore

Selecting a high-quality auto insurance company is difficult considering how many choices drivers have in Maryland. The ranking information in the next section can help you analyze which companies you want to consider purchasing a policy from.

Top 10 Baltimore Car Insurance Companies Overall

- Travelers

- USAA

- Mercury Insurance

- AAA Insurance

- Nationwide

- Allstate

- State Farm

- The Hartford

- Safeco Insurance

- Progressive

Be persistent to save money

People who switch companies do it for a number of reasons such as extreme rates for teen drivers, not issuing a premium refund, delays in paying claims or high prices. Regardless of your reason, finding a great new company is pretty easy and you might even save some money in the process.

In this article, we presented a lot of information how to find cheaper Toyota Prius Prime insurance in Baltimore. The key thing to remember is the more rate quotes you have, the better chance you’ll have of finding affordable Baltimore auto insurance quotes. You may even find the most savings is with a smaller regional carrier.

When searching for inexpensive Baltimore auto insurance quotes, it’s not a good idea to skimp on critical coverages to save a buck or two. Too many times, an insured cut uninsured motorist or liability limits only to regret at claim time that a couple dollars of savings turned into a financial nightmare. Your aim should be to get the best coverage possible at an affordable rate, but do not sacrifice coverage to save money.

Much more information about auto insurance in Maryland is available at the links below

- Car Insurance: When not to Skimp (BankRate.com)

- Who Has Cheap Auto Insurance Quotes for Electric Cars in Baltimore? (FAQ)

- Who Has the Cheapest Baltimore Auto Insurance for Single Moms? (FAQ)

- Who Has Cheap Auto Insurance for a Dodge Ram in Baltimore? (FAQ)

- Who Has Cheap Auto Insurance Quotes for Drivers Over Age 70 in Baltimore? (FAQ)

- Understanding Limits and Deductibles (Allstate)

- Vehicle Safety Ratings (iihs.org)

- Dangers of fake or stolen airbags (Insurance Institute for Highway Safety)

- All About Airbag Safety (State Farm)